|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

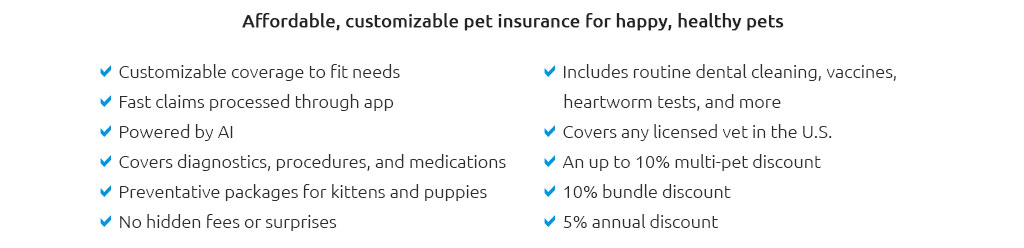

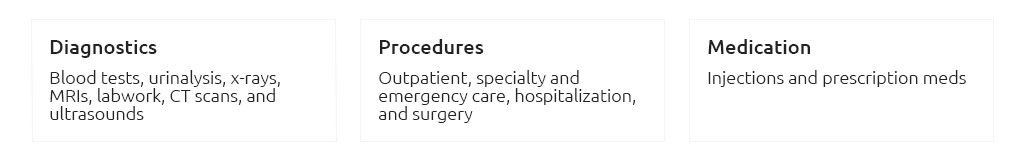

Exploring the World of Custom Pet Insurance: A Comprehensive GuideIn a world where pets have transcended their roles as mere companions to become integral members of our families, it's no wonder that the concept of custom pet insurance is gaining traction. This innovative approach to pet healthcare coverage allows pet owners to tailor insurance plans specifically to their pets' unique needs, offering a level of personalization that standard insurance policies simply cannot match. But what exactly is custom pet insurance, and why should you consider it for your furry, feathery, or scaly friend? At its core, custom pet insurance is designed to provide coverage that aligns closely with the specific health requirements and lifestyle of your pet. Unlike traditional pet insurance, which often offers a one-size-fits-all approach, custom policies allow pet owners to select coverage options that reflect the age, breed, pre-existing conditions, and even the activity level of their pets. This flexibility ensures that you're not paying for unnecessary coverage, while also providing peace of mind that your pet is protected in the ways that matter most. Consider, for instance, a high-energy breed like a Border Collie. Such a dog might benefit from a plan that covers injury treatments more comprehensively, reflecting their active lifestyle and higher risk of physical accidents. On the other hand, a senior cat might require a plan that emphasizes chronic condition management, offering extensive coverage for treatments related to arthritis or kidney disease. With custom pet insurance, these nuances can be addressed directly, ensuring that your pet receives the care they deserve. Beyond these practical considerations, there is also the emotional aspect. The bond between a pet and its owner is profound, and knowing that you've taken steps to protect your pet's health can enhance this relationship. Custom pet insurance is not just about financial protection; it's about honoring the commitment you've made to your pet's wellbeing, showcasing a proactive approach to their healthcare.

However, it's crucial to approach this option with a clear understanding of your pet's needs and the potential gaps in coverage. Consult with veterinarians to gain insights into your pet's health risks and lifestyle needs, ensuring that your chosen policy is both comprehensive and relevant. Frequently Asked QuestionsWhat is custom pet insurance? Custom pet insurance is a type of insurance policy that allows pet owners to select coverage options specifically tailored to their pet's individual health needs and lifestyle, offering a more personalized approach than traditional pet insurance plans. Why should I consider custom pet insurance? Considering custom pet insurance can be beneficial as it provides coverage that aligns closely with your pet’s specific health requirements, potentially making it more cost-effective and ensuring your pet is protected in ways that are most relevant to their lifestyle. How do I determine the right coverage for my pet? Determining the right coverage involves assessing your pet's age, breed, pre-existing conditions, and lifestyle. Consulting with a veterinarian can provide valuable insights into the specific health risks your pet might face, helping you choose the most appropriate policy. Is custom pet insurance more expensive than traditional plans? Custom pet insurance is not necessarily more expensive; in fact, it can be more cost-effective as it allows you to avoid paying for unnecessary coverage, focusing your investment on areas that are most pertinent to your pet’s health. https://www.cbsnews.com/news/how-to-get-personalized-pet-insurance/

By consulting your veterinarian, you can more accurately personalize your pet insurance coverage to only what you need now - or may need in the ... https://figopetinsurance.com/get-started

We use cookies or similar technologies to maintain security, enable user choice and improve our sites. We also set cookies for marketing purposes and to provide ... https://www.libertymutual.com/pet-insurance

We customize. You could save on pet insurance. Start your Pet Insurance quote. Get my price ...

|